BY: Anne-Elise Cugliari Allegritti. Director of Communications, Royal LePage

From surging buyer demand to fluctuating interest rates, the Canadian housing market has seen its fair share of ups and downs since the onset of the pandemic. Through it all, home prices in the country’s luxury markets have stayed relatively stable, weathering the ever-evolving market landscape.

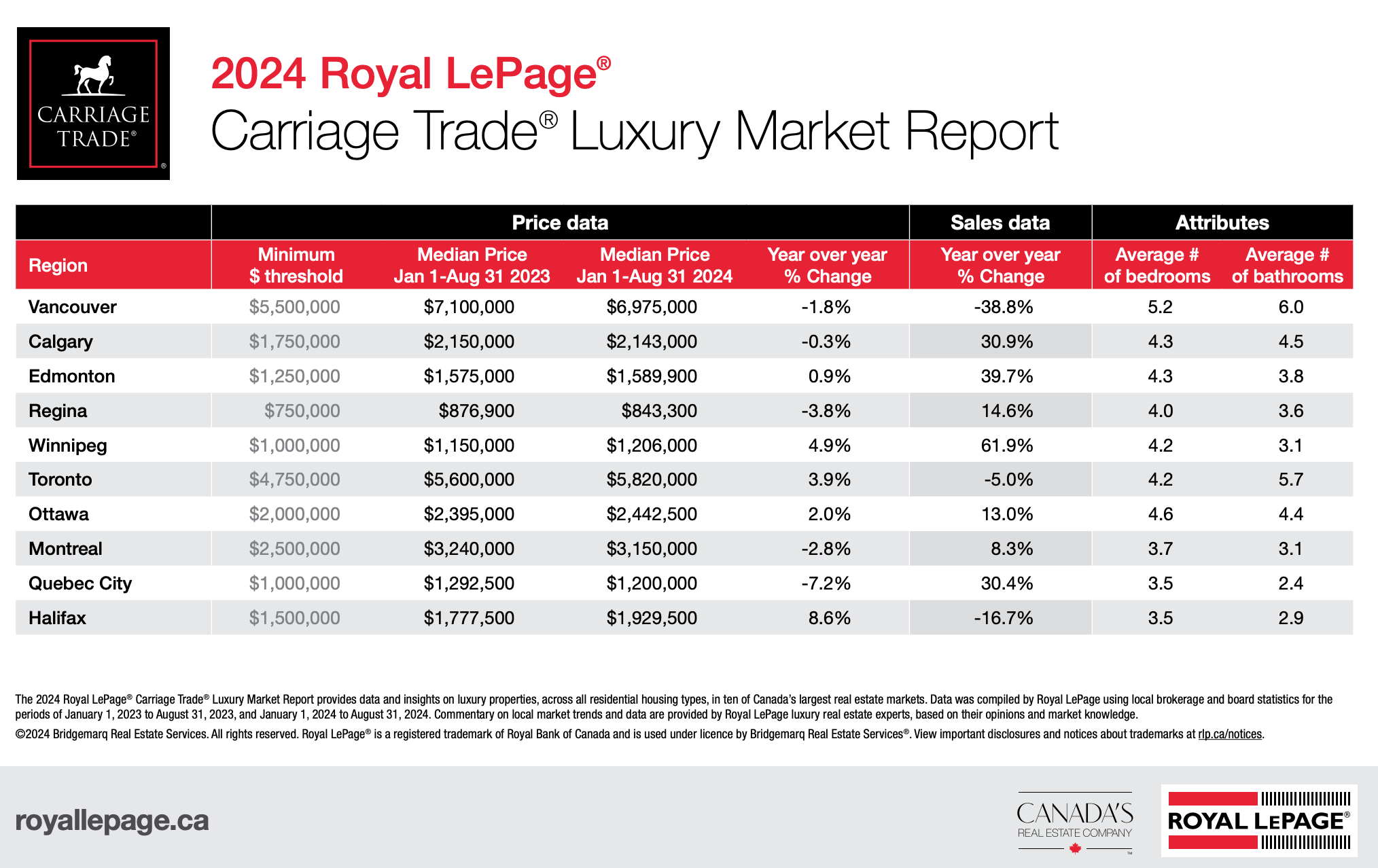

According to the 2024 Royal LePage® Carriage Trade® Luxury Market Report, sales of luxury homes were up in the first eight months of the year, compared to the same period in 2023, in almost all major cities in Canada – with the exception of the two most expensive markets, Vancouver and Toronto, as well as Halifax. Meanwhile, prices posted modest gains in some regions and slight declines in others.

“Homes typically trade hands at the high end of the market at a slower pace than we see in the industry overall, as the funnel of potential purchasers narrows as the price of properties climbs. This affords luxury buyers the luxury of acting more deliberately, taking their time in a quest to find exactly the right home,” said Phil Soper, president and chief executive officer, Royal LePage. “While market conditions can vary from one city or province to the next, the dynamics at play in luxury real estate markets from coast to coast remain consistent: buyers in this segment know what they want and they are willing to wait for it.”

While transaction volumes in the high-end property segment are lower relative to the mainstream residential market, luxury markets in the Prairie provinces recorded some of the largest gains in sales activity year over year in the first eight months of 2024, led by Winnipeg, with Edmonton and Calgary close behind. This is reflective of the strong state of their overall markets, especially Alberta, which has proven more resilient than most of the country over the past year. This is due to its continued strong demand from out-of-province buyers. Outside of the Prairies, Quebec City has also recorded strong luxury sales growth this year.

Looking ahead, experts in all major cities across Canada expect to see brisk activity in the fall market.

Luxury buyers feel boost of confidence, fueling sales

According to Royal LePage regional luxury market experts, buyers in this segment are discerning. In some regions, the high cost of construction is driving demand in the resale segment, where buyers are seeking fully-renovated, turn-key properties. In other areas, buyers prefer to build the custom home of their dreams, despite high cost construction costs and extended timelines.

“Luxury buyers typically have the means to be picky. Their home buying decisions are shaped by more than the desire to live in a particular neighbourhood or to enjoy very specific high-end features and amenities. Often, their decision whether to buy or not is driven by their confidence in the health of the overall economy and the direction they see housing prices headed. Our research shows those in the higher end of the housing market have a very positive outlook on the long-term stability and appreciation potential of Canada’s housing stock,” noted Soper.

“Many buyers in the luxury market segment do not require high-leverage mortgages, where the amount borrowed relative to the value of the underlying property is large. In fact, it is common to see expensive homes purchased with very substantial down payments, or even fully in cash. Thus, luxury homebuyers as a rule are not as heavily impacted by high interest rates as the average consumer. It is primarily the positive impact on macroeconomic factors that will encourage new buyers in the luxury segment.”

Here are a few highlights from the 2024 Royal LePage Carriage Trade Luxury Market Report:

Halifax’s luxury real estate market recorded highest year-over-year median price appreciation in the first eight months of 2024, with gains of 8.6%.

Luxury property prices in Toronto posted year-over-year increase of 3.9%, while Vancouver and Montreal recorded modest declines of 1.8% and 2.8%, respectively.

Sales activity in Winnipeg’s luxury market recorded greatest year-over-year increase with 61.9% jump, taking into account low transaction volumes.

2023 foreign buyer ban has had no material impact on prices or available inventory in most markets

Comments:

Post Your Comment: