National aggregate home price forecast to increase 5.5% year over year in Q4 of 2024

Following several years of unprecedented ups and downs, Canada’s housing market could return to more normal levels of activity and price trends next year. The Bank of Canada is expected to lower its overnight lending rate in the second half of 2024, which will lead to increased demand from sidelined buyers as they adjust to today’s lending realities. New household formation and newcomers to Canada will put additional upward pressure on prices.

“Looking ahead, we see 2024 as an important tipping point for the national economy as most Canadians acknowledge that the ultra-low interest rate era is dead and gone,” said Phil Soper, President and CEO, Royal LePage. “We believe that the ‘great adjustment’ to tolerable, mid-single-digit borrowing costs will have a firm grip on our collective consciousness after only modest rate cuts by the Bank of Canada.”

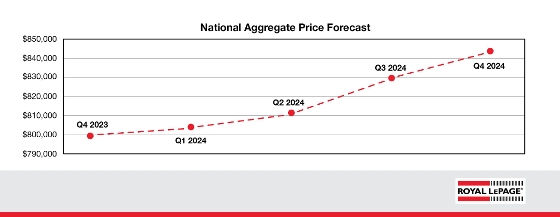

According to the Royal LePage 2024 Market Survey Forecast, the aggregate1 price of a home in Canada is set to increase 5.5% year over year to $843,684 in the fourth quarter of 2024, with the median price of a single-family detached property and condominium projected to increase 6.0% and 5.0% to $879,164 and $616,140, respectively.2

Royal LePage’s forecast is based on the prediction that the Bank of Canada has concluded its interest rate hike campaign and that the key lending rate will hold steady at five percent through the first half of 2024. The central bank is expected to start making modest cuts in late summer or fall of next year. Meanwhile, several major financial institutions have already begun offering discounts on fixed-rate mortgages.

“Canada’s real estate market has been on a roller coaster ride for the last four years. A global pandemic briefly brought market activity to a grinding halt in early 2020, followed by a rapid, widespread spike in demand and price appreciation as Canadians sought safety and greater living space in their homes among a world of uncertainty. By the spring of 2022, home prices had reached unprecedented highs, but when interest rates started rising quickly and steeply to combat inflation, the extended market correction began,” said Soper. “Markets take time to adjust. We see a move toward typical home sale transaction levels in 2024, and as the year progresses, appreciating house prices.”

Nationally, home prices are forecast to see modest quarterly gains in the first two quarters of 2024, with more considerable increases expected in the second half of the year, following the anticipated start of interest rate cuts by the Bank of Canada.